1. Current Status and Summary

Masstock Arable (UK) Limited “Masstock” is an established business, incorporated in May 1989. Based in Andoversford, Cheltenham, we operate in the agricultural services sector, providing agronomy advice, crop inputs and digital solutions for farmers and growers.

Masstock has undergone multiple acquisitions since incorporation. The latest being in 2010 when Masstock Arable (UK) Ltd and United Agrii Products were acquired by the Origin Enterprises Group, with our ultimate Parent being Origin Enterprises Luxembourg SARL.

Masstock Arable (UK) Limited use the trading names Agrii, GB Seeds, Rhiza and Agrii Finance

Agrii – provides agronomy services, technology, and strategic advice through our skilled agronomists to farmers and growers. Through Agrii we deliver expertise and support for sustainable and profitable farming systems in the UK. We work with over 20,000 farmers, providing management advice on 1.4mHa of combinable crops, representing some 40% of UK agricultural output.

GB Seeds –. This part of our company specialises in working with added value crops and grains. Our range of seeds provides growers with a chance to diversify their crop options and we also supply a range of seeds for farmers to grow.

Rhiza – through digital technology we provide an independent, standalone service to support farming businesses. This includes boundary mapping, georeferenced cropping, hyperlocal weather, crop growth models, yield predictions and planning services. We offer four different service options, dependant on the client’s needs.

Agrii Finance – This part of our company is highlighted on our marketing material. It gives the customer the option of an alternative payment method which often suits their cash flow situation.

Masstock Arable (UK) Limited is a growing business. We reported a Turnover of £393m in the last financial year ending 31 July 2022 (£300m FYE 31 July 2021).

We currently operate from 39 sites throughout the UK and employ circa 910 staff.

Through Masstock Arable (UK) Limited, using the trading names above, we operate a range of services to the agricultural sector. As well as our agronomy services, we help out clients with advice, purchase seeds, fertilizers, machinery, and other ancillary services.

To assist our clients, we offer a finance option. Due to the nature of the agricultural industry, cash flow is seasonal, and having a finance option available assists them with their cash flow. The finance option is solely to use on purchasing products through our business.

In order to offer finance, Masstock Arable (UK) Limited have been authorised and registered with the FCA as a credit broker, FRN: 710790 since October 2015.

We work in partnership with De Lage Landen Leasing Limited “DLL”, FRN: 668687, to offer a finance facility. We do not provide any advice to clients but will refer clients who require finance directly to DLL. Following the referral, Masstock do not have any further involvement in the finance application.

In the last 12 months we have brokered finance for 1400 clients, amounting in total to circa £37m. We anticipate in the next 12 months we will broker between 1000-1400 finance applications.

1.1 Senior Management Arrangements

Masstock Arable (UK) Limited are a limited company with circa 910 staff, of whom 20 are actively engaged in regulated business activities.

We have a Board of 12 Directors that manages the firm on a day-to-day basis. Our board members are experience individuals who have been in the business and industry for many years and have experience in all aspects of agricultural and crop inputs.

The board meet on a regular basis as a management team using a set agenda to discuss key issues, and record decisions made, and actions that need to be taken. Department managers prepare reports on key issues with relevant Key Performance Indicators (KPIs) which are considered by the Board to assist them in their decision-making. The Board is responsible for approving the Company’s policies and procedures which are used to ensure our core business activities are properly controlled.

Chief Operating Officer, Spencer Evans (SMF29) has overall responsibility for compliance in relation to our credit broking activities.

Further information is available upon request for the Agrii and Origin Board structures.

2. Key Personnel

Spencer Evans, Chief Operating Officer, SMF29

Spencer is a qualified accountant and fellow of the Association of Chartered Certified Accountants, having qualified in 1996.

In a career spanning over 30 years, he has held a number of Financial Director, or equivalent, positions in UK and US listed companies. He has been a statutory director of many different companies throughout this period and understands well the fiduciary duties these entail.

Much of his experience has been in leadership roles in highly regulated industries including aerospace, defence, advanced materials, and government funded research. These have required an understanding of strict regulations with respect to working practices, data management and financial policies. Institutions where Spencer has interacted with to ensure compliance have included the UK Ministry of Defence, the US Department of Defence and other government agencies. This has included, where required, appropriate security clearances.

Lee Woodall, Finance Director, Compliance Officer

Lee is a qualified accountant and an Associate of the Chartered Institute of Management Accounts.

In a career spanning 25 years he has held a number of Finance roles in the UK. This has included 7 years as Finance Director.

Much of his 25 years’ experience has been in management or leadership roles for companies with a global parent ownership.

These companies have operated with strict working practices, data management and financial policies and controls.

3. Management Roles and Responsibilities

| Name | Role | Professional qualifications | Industry experience | Experience in area of expertise | Primary responsibilities |

| Ronan Hughes | Manging Director | FCMA | 35 years | 35 years | Day to day, strategic and financial responsibility. |

| Spencer Evans | COO | FCCA | 7 years | 32 years | Board member responsible for the leadership of Agrii operations and back-office functions including compliance and information systems |

| Lee Woodall | Finance Director | ACMA | 6 months | 25 years | Board member responsible for the leadership of the Agrii Finance Operations including compliance. |

| John Stevenson | Regional Commercial Director | BSC | 29 years | 29 years | Board member responsible for performance & activities in the South region. Management of 13 teams with 130 technical sales driven employees. |

| Mark Taylor | Regional Commercial Director | None | 28 Years | 40 years | Board member responsible for performance & activities in the South region. Management of 13 teams with 150 technical sales driven employees. |

| Lee Robinson | Head of Seed | None | 46 Years | 46 Years | Board member responsible for the commercial seed activity including setting the strategic goals, Product development. Profitability, margin growth and customer acquisition and retention strategies. |

| Peter Vinestock | Head of Operations | BCOM, FCILT | 22 years | 34 years | Board member responsible for operations covering seed production and chemical logistics at approx. 30 sites. |

| Chris Glover | Head of Crop Protection | BASIS: MBPR. BETA. ICM. Nutrient Management Planning certificate. | 25 years | 25 years | Board member responsible for commercial product strategy including buying, planning and negotiation. |

| Ruth Mann | Head of Integrated Corp Technologies | BSc Hons in Applied Biology, Post Graduate CP Diploma, Plant Protection Award, BASIS. | 6 years | 26 years | Board member responsible for Research leadership, Agronomic Strategy and Technical Support. |

| Garth Bretherton | Head of Sales & Marketing | CIM Certificate in Digital Marketing, OU Certificate in Management, BSC Hons International Agribusiness Management | 27 years | 28 years | Crop Input Specialist Sales, Marketing, Business Development, RHIZA, Crop Input Sales and Digital Customer Experience projects. |

| Nicola O'Keefe | Credit Management & risk Lead | None | 6 years | 34 years | To lead and oversee process, policies and best practice in all areas relating to Credit, Debt, Agrii Finance and Product Claims. |

| Emma Davy | Credit Manager | None | 21 years | 21 years | Operational Management of the Credit Control teams for cash collection and debt reduction and Agrii Finance administration |

| Andrea Jackson | Risk Manager | BTEC HND (Business Studies), ACICM | 4 years | 32 years | Operational management of risk mitigation and exposure in relation to Credit, Debt and Product Claims. |

4. Business Activities

4.1 Business Model

Masstock Arable (UK) Limited is an established business, a leading provider of agronomy services, technology and strategic advice services operating in the agricultural industry.

Through our 39 branches we offer advice, digital agricultural solutions, crop inputs and digital solutions for both farmers and growers throughout the UK.

We cover a wide range of services, though our Agrii trading name, we offer agronomy services, technology, and advice We also offer farmers a range of ancillary products such as safety equipment, fertilisers, chemical storage, crop covers, fencing, sprayers, vineyard products and biological controls. Our services also include assisting farmers with crop marketing through our partner, Glenmore Agriculture.

Through trading name GB Seeds, we work with farmers and growers to supply a range of seeds.

Through our trading name, RHIZA, we provide a digital technology service which supports farming businesses.

Income in the agricultural industry is seasonal/cyclical and therefore Masstock offer our farmers and growers a finance option to pay for our goods/services.

Finance is offered at two stages to clients. Firstly, a client can apply for finance at the point of ordering products and services. In this case, the application is submitted to the lender and goods/services are provided on finance acceptance by the client and the lender.

The second stage that clients might be offered finance is upon invoicing. Owing to the nature of the farming industry and seasonal cash flow challenges, it might be prudent for clients at the point of invoice to consider finance which they were initially not planning to take due to cashflow. Clients still undertake a thorough application process by the lender to demonstrate affordability of repayments; however, their decision to finance the agreement is driven by a change of plans regarding lump sum cash availability.

Existing borrowers are also provided with an indicative credit limit by the lender; however, every application for credit is underwritten by the lender to ensure affordability regardless of the indicative figures provided.

We brokered finance application for around 1200 clients in the last 12 months and received commission of £141k from the lender for our credit broking activities.

Our finance options range from 1-9 months, with an average loan of circa £20K.

4.2 Financial Summary

| Masstock Arable (UK) Ltd | FYE 31/7/2022 | FYE 31/7/2021 |

| Total Revenue | £392,876,000 | £300,299,000 |

| Expenses | £383,491,000 | £285,943,000 |

| Profit Before Tax | £9,385,000 | £14,356,000 |

| Shareholders’ Equity | £40,818,000 | £33,330,000 |

4.3 Client Money

We will not hold client money on our own account.

4.4 Pricing

Regulated income is derived from an annual volume related bonus provided by the lender DLL.

Volume Bonus level details are as follows:

| New Business Volume | VB Payable | Value | Conditions |

| £0 - £20m | 0.25% | £50,000 | |

| £20m - £30m | 0.55% | £55,000 | 0.55% is applicable to increment if new business of £30m is achieved. If new business is less than £30m then the bonus will be calculated at the previous increment value. |

| £30m - £40m | 0.90% | £90,000 | 0.90% is applicable to increment if new business of £40m is achieved. If new business is less than £40m then the bonus will be calculated at the previous increment value. |

| £40m + | 1% | 1% is applicable to increment if new business of £50m is achieved. If new business is less than £50m then the bonus will be calculated at the previous increment value. |

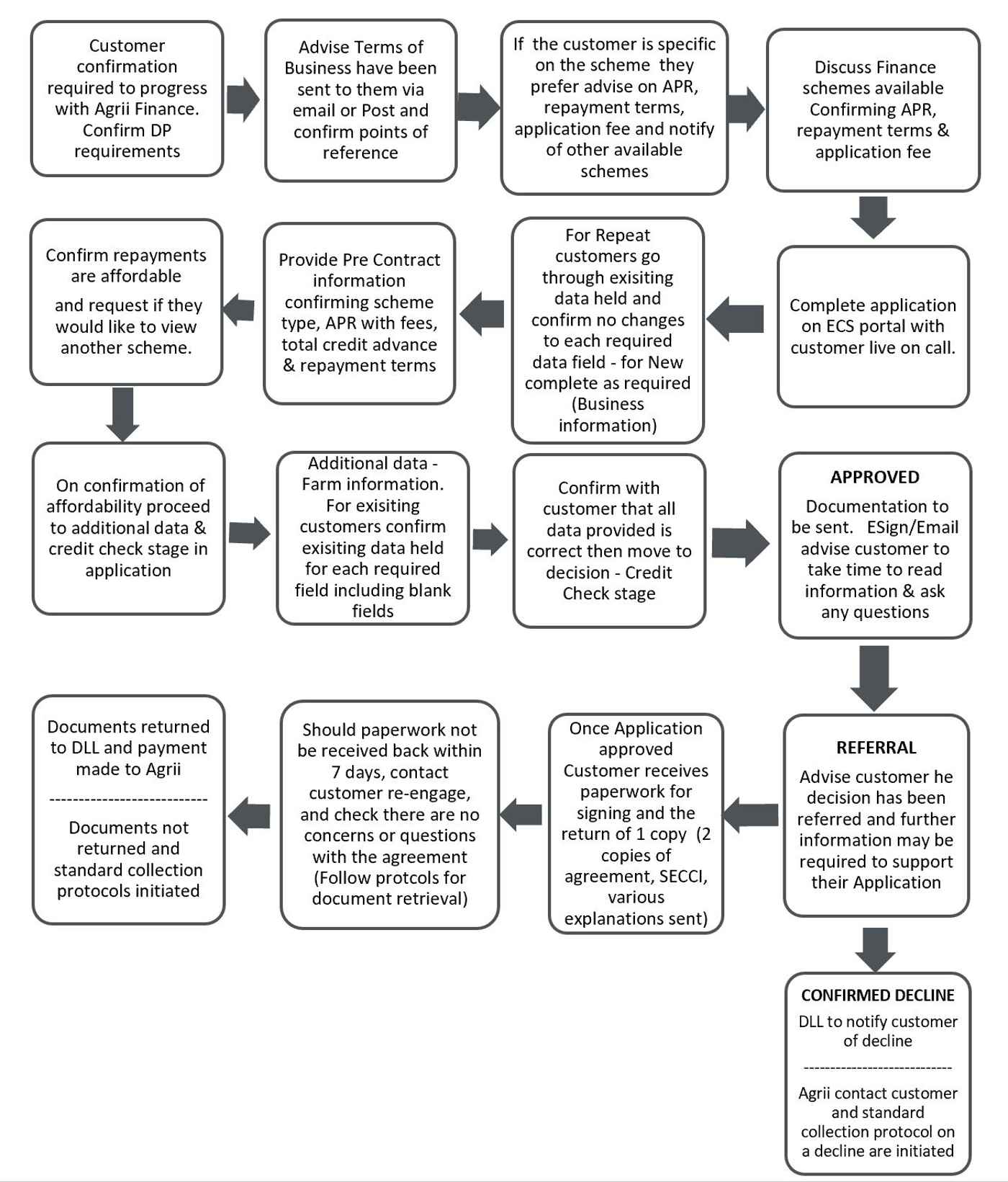

5. Sales Process

6. Source of Clients and Sales Channels

All clients are UK based, sole traders, partnerships and limited companies within the agricultural sector who are looking for an alternative funding method to finance our products/services.

We use multiple channels to get the messages out to customer and prospects, these include email, text messages, mail the internet, social media, press releases, online and offline advertising, and marketing collateral.

7. Compliance Arrangements

Masstock recognises the importance of regulatory compliance and implementing effective controls for managing compliance.

We have therefore taken the following steps;

- Spencer Evans will take primary responsibility for compliance and TCF.

- Spencer Evans will look after compliance on a day-to-day basis.

- All staff will receive training in key compliance issues.

- We have a support contract in place with Compliancy Services covering the following key areas:

- Provision of compliant policies and procedures

- Compliance audits

- Assistance with complaints

- Compliance training

- Compliance help desk

- Regulatory updates

7.1 Consumer Credit Sourcebook Requirements (“CONC”) Requirements

7.1.1 Marketing

Masstock promotes its services through our three websites and general word of mouth from its current customers. We have a written financial promotions policy in place.

Our websites are:

7.1.2 Training

Masstock has engaged with compliance consultants, Cosegic Ltd to provide compliance support and to ensure the firm keeps up to date with any changes on regulation.

Our staff also receive training from the lender. This enables staff to be able to guide the customer to a suitable product, and ensure the client meets the lenders lending criteria.

All sales staff are trained on lender requirements through company and lender training. This is followed by assessment of knowledge retention.

Periodic lender updates are circulated to each salesperson as they become known from the lender, and staff will be required to acknowledge receipt and understanding.

7.1.3 Data Protection

Our Terms of Business letter fully describes the circumstances under which we would disclose to lenders potential customer details.

We discuss this with the customer as part of the process of giving a verbal review of the Terms of Business when handed to the customer at the outset of the initial meeting.

7.1.4 Part of a Group

Masstock is not linked to any lenders and as such, this information is brought to the attention of our customer through our Terms of Business letter and verbal explanation.

7.1.5 Due Diligence and FCA authorisation

Masstock will carry out necessary due diligence on any firm that it is considering a business arrangement with.

If the activity is to be one of which would require the firm to hold FCA permissions, we will require evidential material that the firm is suitably authorised and regulated with the correct permissions by the FCA.

7.2 Treating Customers Fairly

| Risk | Mitigation system | Mitigation controls |

| Clients may misunderstand the nature of our services and consequences of non-payment of fees. | Terms of business and letters are all in clear, plain, jargon free language and client is questioned in order to ensure understanding. | Our Terms of Business and letters are constantly reviewed to ensure that the information passes “customer sense checks”. As such if we receive negative feedback that something was not made clear, it is our policy to make appropriate changes. At the outset we sense check the information ourselves and wherever possible we will enlist the help of non- regulatory persons to provide the potential consumer experience to us. |

| Recommendations made to clients are unsuitable. | It is practice to restate our understanding of clients’ circumstances, key features of credit are fully explained in clear, simple language, cancellation rights are highlighted, and clients are given the opportunity to ask questions. Management information is kept to record sales not proceeded with, cancelled, or deemed unsuitable. | Internal and external file audits will be carried out in line with our compliance policy that provides Management Information on the results for appropriate action. Should any case be found to have been unsuitable we will take immediate steps to put the customer back to the position they were in prior to the sale taking place. The senior management reviews this data to refresh our sales process as necessary and investigate any inconsistencies |

| Customers do not receive satisfactory responses to their complaints. | All expressions of dissatisfaction by customers will be treated seriously as eligible complaints & dealt with in accordance with prescribed procedures. Soft complaints will be rectified as far as is possible and fed into business reviews, staff will be obliged to read and sign off training materials every 6 months & when changes are made to personnel, and complaints procedures will readily be available for staff to give to customers. | Our Directors will investigate and deal with complaints accordingly and check staff training records. Complaints will be looked at in two ways, 1) as an individual complaint – and actioned accordingly 2) to see if any systemic failure has occurred – if so, remedial action will be undertaken and a past cases review will be undertaken on any activity that may have been subject to systemic failure even though no other complaint may have been received. |

| We do not keep up with regulatory and legal changes to the detriment of customers | Our compliance staff, senior managers and directors will undertake regular professional development activities and subscribe to updates from our support provider and from trade publications. | All staff will have a training file that is regularly reviewed for completeness. In addition to the training file, all staff responsible for customer dealings will be required to complete a Continuing Professional Development (CPD) Plan that form part of their assessment under regular staff appraisals. All staff will be notified internally of material legislative changes that could affect our customer advice and dealings. |

| Remuneration policy encourages inappropriate non-consumer friendly practices such as mis-selling. | Salary and bonuses will not purely dictated by sales levels. We will use a range of factors to assess remuneration (Key Performance Indicators - KPI) that include record keeping, suitability and delivery within timescales. | File reviews, audits, staff assessments and complaints. |

| Management Information is recorded in such a way that it is not possible to identify trends and build a clear picture of business risks/other risks to customers. | Information is kept up to date and accurate, reports are clear & examination of lead indicators i.e., customer touch points. | Record keeping is a Key Performance Indicator (KPI) and regular business reviews include all pertinent areas so that they are not overlooked. |

| Customers are adversely affected by changes in the firm e.g., brokerage activities in relation to new products. | Business plan is in place and is subject to review, and strategic changes are fully analysed before proceeding. | Forthcoming changes will be considered and analysed significantly in advance of changes being implemented. |

| Customers are adversely affected by conflicts of interest. | Staff will be prohibited from accepting benefits that create specific ties. Hospitality, gifts, and other conflicts will be recorded and declared. | File reviews and audits, analysis of business statistics, where conflicts are discovered, these are disclosed, and clients are permitted to make their own decisions. |

7.3 Financial Crime

7.3.1 Knowledge of duties

We will ensure that we only appoint a senior member of staff to deal with our financial crime matters with the appropriate skills, seniority, and experience to carry out their role.

We will also ensure that the senior member of staff responsible for managing financial crime is given adequate training, resources, and a direct reporting line to management in order to carry out his/her duties effectively.

The senior member of staff responsible for managing financial crime will also be subject to regular assessment during firm appraisals. Furthermore, all staff members undergo annual financial crime refresher training.

7.3.2 Identity verification

In relation to evidence of identity, it will be our policy that we will not establish business/customer relationships until all relevant parties have been identified. If satisfactory evidence cannot be obtained, business will not proceed further.

7.3.3 Know your business information

It will be our policy to ensure that a financial crime risk assessment is undertaken annually.

This will be used to shape our risk-based approach to the management of financial crime. The assessment will cover money laundering, fraud, and bribery.

Money laundering concerns will also be raised internally to management through the provision of annual money laundering reports. Finally, our financial crime systems and controls will be subject to an independent annual audit.

7.3.4 Training

All staff will be given financial crime training once per annum, upon induction to the firm, and in the event that circumstances reveal staff knowledge to be lacking whether through appraisal or other means and. All staff training is recorded.

7.3.5 Disciplinary procedures

Members of staff who fail to promptly report money laundering suspicions/belief that money laundering may be occurring may be subject to our disciplinary procedures.

A range of sanctions are available against employees who engage in/assist financial crime and these are described in our Disciplinary Policy.

Disciplinary action ranges from retraining to dismissal after investigation. If criminality is suspected, we will also notify the FCA/police.

7.4 Risk Management – Business Risks

| Cash flow and capital | An annual business plan is forecast and a monthly review of performance against forecasts is to be carried out |

| Key Person risk | The directors, senior management and staff are experienced and can provide cover for each other if required. |

| Competitive Risks | This business an established business with an excellent reputation in this industry sector. |

| Fraud & AML | Appropriate financial crime policies will be implemented to ensure robust controls are implemented. |

6. Source of Clients and Sales Channels

All clients are UK based, sole traders, partnerships and limited companies within the agricultural sector who are looking for an alternative funding method to finance our products/services.

We use multiple channels to get the messages out to customer and prospects, these include email, text messages, mail the internet, social media, press releases, online and offline advertising, and marketing collateral.

7. Compliance Arrangements

Masstock recognises the importance of regulatory compliance and implementing effective controls for managing compliance.

We have therefore taken the following steps;

- Spencer Evans will take primary responsibility for compliance and TCF.

- Spencer Evans will look after compliance on a day-to-day basis.

- All staff will receive training in key compliance issues.

- We have a support contract in place with Compliancy Services covering the following key areas:

- Provision of compliant policies and procedures

- Compliance audits

- Assistance with complaints

- Compliance training

- Compliance help desk

- Regulatory updates

7.1 Consumer Credit Sourcebook Requirements (“CONC”) Requirements

7.1.1 Marketing

Masstock promotes its services through our three websites and general word of mouth from its current customers. We have a written financial promotions policy in place.

Our websites are:

7.1.2 Training

Masstock has engaged with compliance consultants, Cosegic Ltd to provide compliance support and to ensure the firm keeps up to date with any changes on regulation.

Our staff also receive training from the lender. This enables staff to be able to guide the customer to a suitable product, and ensure the client meets the lenders lending criteria.

All sales staff are trained on lender requirements through company and lender training. This is followed by assessment of knowledge retention.

Periodic lender updates are circulated to each salesperson as they become known from the lender, and staff will be required to acknowledge receipt and understanding.

7.1.3 Data Protection

Our Terms of Business letter fully describes the circumstances under which we would disclose to lenders potential customer details.

We discuss this with the customer as part of the process of giving a verbal review of the Terms of Business when handed to the customer at the outset of the initial meeting.

7.1.4 Part of a Group

Masstock is not linked to any lenders and as such, this information is brought to the attention of our customer through our Terms of Business letter and verbal explanation.

7.1.5 Due Diligence and FCA authorisation

Masstock will carry out necessary due diligence on any firm that it is considering a business arrangement with.

If the activity is to be one of which would require the firm to hold FCA permissions, we will require evidential material that the firm is suitably authorised and regulated with the correct permissions by the FCA.

7.2 Treating Customers Fairly

| Risk | Mitigation system | Mitigation controls |

| Clients may misunderstand the nature of our services and consequences of non-payment of fees. | Terms of business and letters are all in clear, plain, jargon free language and client is questioned in order to ensure understanding. | Our Terms of Business and letters are constantly reviewed to ensure that the information passes “customer sense checks”. As such if we receive negative feedback that something was not made clear, it is our policy to make appropriate changes. At the outset we sense check the information ourselves and wherever possible we will enlist the help of non- regulatory persons to provide the potential consumer experience to us. |

| Recommendations made to clients are unsuitable. | It is practice to restate our understanding of clients’ circumstances, key features of credit are fully explained in clear, simple language, cancellation rights are highlighted, and clients are given the opportunity to ask questions. Management information is kept to record sales not proceeded with, cancelled, or deemed unsuitable. | Internal and external file audits will be carried out in line with our compliance policy that provides Management Information on the results for appropriate action. Should any case be found to have been unsuitable we will take immediate steps to put the customer back to the position they were in prior to the sale taking place. The senior management reviews this data to refresh our sales process as necessary and investigate any inconsistencies |

| Customers do not receive satisfactory responses to their complaints. | All expressions of dissatisfaction by customers will be treated seriously as eligible complaints & dealt with in accordance with prescribed procedures. Soft complaints will be rectified as far as is possible and fed into business reviews, staff will be obliged to read and sign off training materials every 6 months & when changes are made to personnel, and complaints procedures will readily be available for staff to give to customers. | Our Directors will investigate and deal with complaints accordingly and check staff training records. Complaints will be looked at in two ways, 1) as an individual complaint – and actioned accordingly 2) to see if any systemic failure has occurred – if so, remedial action will be undertaken and a past cases review will be undertaken on any activity that may have been subject to systemic failure even though no other complaint may have been received. |

| We do not keep up with regulatory and legal changes to the detriment of customers | Our compliance staff, senior managers and directors will undertake regular professional development activities and subscribe to updates from our support provider and from trade publications. | All staff will have a training file that is regularly reviewed for completeness. In addition to the training file, all staff responsible for customer dealings will be required to complete a Continuing Professional Development (CPD) Plan that form part of their assessment under regular staff appraisals. All staff will be notified internally of material legislative changes that could affect our customer advice and dealings. |

| Remuneration policy encourages inappropriate non-consumer friendly practices such as mis-selling. | Salary and bonuses will not purely dictated by sales levels. We will use a range of factors to assess remuneration (Key Performance Indicators - KPI) that include record keeping, suitability and delivery within timescales. | File reviews, audits, staff assessments and complaints. |

| Management Information is recorded in such a way that it is not possible to identify trends and build a clear picture of business risks/other risks to customers. | Information is kept up to date and accurate, reports are clear & examination of lead indicators i.e., customer touch points. | Record keeping is a Key Performance Indicator (KPI) and regular business reviews include all pertinent areas so that they are not overlooked. |

| Customers are adversely affected by changes in the firm e.g., brokerage activities in relation to new products. | Business plan is in place and is subject to review, and strategic changes are fully analysed before proceeding. | Forthcoming changes will be considered and analysed significantly in advance of changes being implemented. |

| Customers are adversely affected by conflicts of interest. | Staff will be prohibited from accepting benefits that create specific ties. Hospitality, gifts, and other conflicts will be recorded and declared. | File reviews and audits, analysis of business statistics, where conflicts are discovered, these are disclosed, and clients are permitted to make their own decisions. |

7.3 Financial Crime

7.3.1 Knowledge of duties

We will ensure that we only appoint a senior member of staff to deal with our financial crime matters with the appropriate skills, seniority, and experience to carry out their role.

We will also ensure that the senior member of staff responsible for managing financial crime is given adequate training, resources, and a direct reporting line to management in order to carry out his/her duties effectively.

The senior member of staff responsible for managing financial crime will also be subject to regular assessment during firm appraisals. Furthermore, all staff members undergo annual financial crime refresher training.

7.3.2 Identity verification

In relation to evidence of identity, it will be our policy that we will not establish business/customer relationships until all relevant parties have been identified. If satisfactory evidence cannot be obtained, business will not proceed further.

7.3.3 Know your business information

It will be our policy to ensure that a financial crime risk assessment is undertaken annually.

This will be used to shape our risk-based approach to the management of financial crime. The assessment will cover money laundering, fraud, and bribery.

Money laundering concerns will also be raised internally to management through the provision of annual money laundering reports. Finally, our financial crime systems and controls will be subject to an independent annual audit.

7.3.4 Training

All staff will be given financial crime training once per annum, upon induction to the firm, and in the event that circumstances reveal staff knowledge to be lacking whether through appraisal or other means and. All staff training is recorded.

7.3.5 Disciplinary procedures

Members of staff who fail to promptly report money laundering suspicions/belief that money laundering may be occurring may be subject to our disciplinary procedures.

A range of sanctions are available against employees who engage in/assist financial crime and these are described in our Disciplinary Policy.

Disciplinary action ranges from retraining to dismissal after investigation. If criminality is suspected, we will also notify the FCA/police.

7.4 Risk Management – Business Risks

| Cash flow and capital | An annual business plan is forecast and a monthly review of performance against forecasts is to be carried out |

| Key Person risk | The directors, senior management and staff are experienced and can provide cover for each other if required. |

| Competitive Risks | This business an established business with an excellent reputation in this industry sector. |

| Fraud & AML | Appropriate financial crime policies will be implemented to ensure robust controls are implemented. |